How Do Minimum Wage Violations Occur?

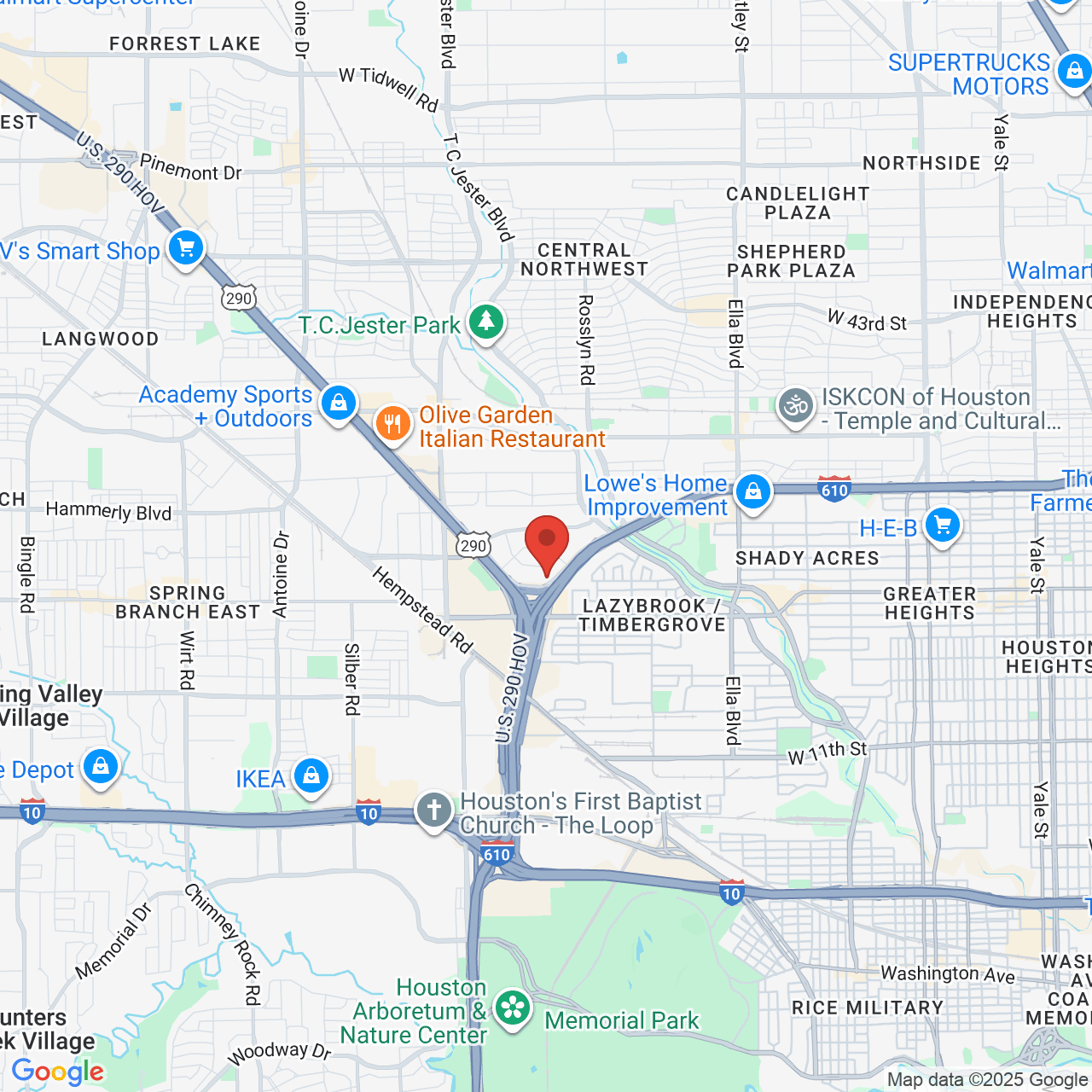

The minimum wage in the United States and Texas is presently $7.25 per hour. That means that, in most circumstances, an employer must pay an employee at least $7.25 for every hour the employee works. You might be surprised by how common minimum wage violations are in this country. The violations are not always obvious. Businesses pay their workers in all kinds of ways – salary, hourly, commission, piece rate, or combinations thereof. Sometimes these arrangements do not guarantee that workers are paid minimum wage for all the hours they work. Sometimes the employer takes actions or institutes policies that reduce the employee’s actual pay below the minimum wage level. Each person’s situation is different, and depends on the specific facts and circumstances of their work and pay. Workers in Houston, TX, who have concerns over compliance can benefit from the assistance of a knowledgeable minimum wage lawyer at The Buenker Law Firm.

Less Than Minimum Wage? How Does That Happen?

Minimum wage violations are often not evident on pay stubs. A minimum wage violation can occur when an employer requires an employee to do something or pay for something that reduces their earned wages.

Ask yourself these questions:

- Are you required to make up for cash drawer shortages? Some retail stores improperly deduct cash drawer shortages from the employee working the register, bringing their effective hourly rate below $7.25.

- Are you required to pay for walked tabs? Some restaurants force their wait-staff to pay for food and beverage orders that the customer does not pay, which can reduce actual pay below $7.25 per hour.

- Are you required to purchase or pay to launder your uniform? Deductions from pay for uniform purchases or laundering of uniforms can reduce actual pay below $7.25 per hour.

- Are you required to pay for tools or equipment related to your job? Some employers require employees to pay for tools or equipment and deduct payments from payroll. If those deductions reduce pay below $7.25 per hour, there may be a minimum wage violation.

- Are you required to pay your employer for damage done to company property? Some employers require employees to pay for such damages and deduct payments from payroll. If those deductions reduce pay below $7.25 per hour, there may be a minimum wage violation.

- Are you a tipped employee without a minimum wage guarantee? The FLSA allows employers to pay tipped employees (i.e., wait-staff) an hourly wage as low as $2.13 with the employees’ tips being the majority of their pay. However, the employer has to guarantee that each workweek, the employee makes a minimum of $7.25 per hour for all hours worked. If the employer fails to do this, there may be a minimum wage violation.

- Are you paid a salary so low that it makes your actual hourly rate less than $7.25 an hour? Sometimes a salaried employee works so many hours in a workweek that their effective hourly rate is below $7.25. If they are not exempt, this is likely a violation of the FLSA’s minimum wage provisions.

Minimum wage violations are often not evident on pay stubs.

These are just some examples of situations that can reduce the "real" pay an employee receives below the required minimum wage amount.

Contact Our Firm

If your answer to any of these questions is "yes", The Buenker Law Firm can provide the aggressive representation you need. Contact us online or call us at (713) 868-3388.